Raising the Bar- Elevating Financial Standards: Driving Success and Sustainability through Internal Controls.

The Internal Financial Control (IFC)

Gaining control over various aspects of Business enables us to acquire deeper insights, potentially shielding us from unforeseen contingencies in the future. This principle is particularly pertinent in the context of a company’s financial management. By exercising control over financial processes, businesses can effectively safeguard their organization, mitigate risks, and furnish reasonable assurance regarding the integrity and accuracy of their financial operations.

Internal Financial Controls – An operational framework designed to ensure the precision of financial information, proactively detect and mitigate instances of fraud and errors, and maintain strict adherence to legal and regulatory obligations.

Key Insights:

By the conclusion of this article, readers should have gained a comprehensive understanding, both quantitatively and qualitatively, of the following aspects:

- The definition and essence of Internal Financial Control (IFC).

- The overarching objectives driving the implementation of IFC.

- The extent and parameters defining the coverage and scope of IFC.

- The pivotal significance and rationale underlying the importance of IFC.

- Effective strategies for the enforcement and sustenance of IFC mechanisms.

- The multifaceted advantages and benefits stemming from the adoption and integration of robust IFC practices.

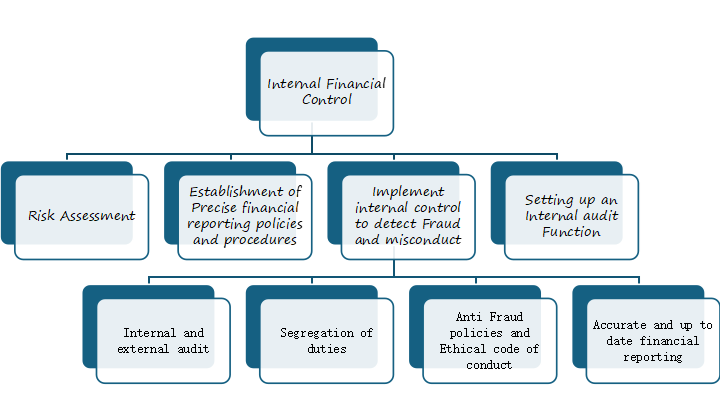

Internal Financial Controls- Strategic Pillars for the Business Well Being:

Set up per the Section 134(5)(e) of the companies Act, 2013,the term “Internal Financial Control” refers to the structured array of processes, policies, and procedures adopted by an organization to uphold the reliability of financial reporting, adhere to legal mandates and regulatory requirements, and optimize the effectiveness and efficiency of operational functions. These controls are strategically instituted to safeguard assets, mitigate the risk of fraudulent activities, and guarantee the precision and comprehensiveness of financial data.

Internal financial controls play a crucial role in enhancing operational efficiency by ensuring adherence to budgets, compliance with policies, identification of capital shortages, and generation of accurate reports for leadership.

Internal financial controls have long been a focal point within the audit and auditing community. Even predating the introduction of Section 134 of the Companies Act 2013, regulatory bodies such as SEBI have underscored the importance of internal financial controls, particularly for listed companies. These controls have been recognized as essential components for ensuring the integrity and reliability of financial reporting and have been subject to scrutiny and oversight by regulatory authorities to maintain market transparency and investor confidence.

Internal financial control (IFC) is a meticulously crafted process aimed at furnishing a high level of confidence regarding the reliability and accuracy of financial reporting. Robust internal controls serve as a pivotal deterrent against errors and fraudulent activities, while also aiding in their timely detection if they do occur. Sound corporate governance underscores the critical importance of internal financial controls in ensuring transparency, accountability, and integrity within an organization.

Unlocking the Intent: Strategic Imperatives: Why Every Organization Needs Robust Internal Financial Control Mechanisms:

Maximizing Efficiency by Cultivating Financial Resilience in Business Operations:

Enhanced financial controls offer substantial benefits to both the company and its stakeholders.

The adoption of Internal Financial Controls (IFC) has witnessed a notable surge in our nation, propelled by the escalating scale of business activities and investments, both domestically and internationally. IFC is applicable across businesses, irrespective of their size or investment magnitude. Its fundamental objective is to guarantee that a company’s financial statements faithfully portray its financial standing and operational performance.

In India, the Securities and Exchange Board of India (SEBI) has mandated the establishment and maintenance of IFCs for all listed companies, underscoring the significance of robust financial governance practices. Furthermore, the enactment of Section 134 of the Companies Act 2013 has standardized the process, application, and accountability associated with IFC, providing a structured framework for compliance and oversight.

The following are the primary rationales for implementing a robust internal financial control mechanism:

- Protection of Assets and Resources.

- Ensuring Reliable and Trustworthy Financial Reporting.

- Prevention of Errors and Fraud.

- Heightened Accountability and Transparency.

- Facilitating Informed and Strategic Decision Making.

- Adherence to Regulatory Requirements and Compliance Standards.

- Augmented Efficiency and Effectiveness in Operations.

Mapping the Territory: Assessing the Scope of Internal Financial Controls:

Internal financial controls have been a central focus for businesses, serving as cornerstone elements in the administration of auditing and accounting procedures within the finance department. They are instrumental in upholding the integrity of financial reporting and ensuring compliance with regulatory requirements. By facilitating adherence to laws and regulations, internal financial controls play a crucial role in mitigating errors and fraudulent activities.

Given the significance of internal financial controls, it is imperative to assess their scope and coverage. This entails delineating the various activities within the entity that necessitate monitoring and control to fall under the purview of internal financial controls.

IFC covers the following:

Turning the Tide: Internal Controls in the Wake of Scandal: The scam that called for strengthened Internal Controls:

dictating the internal controls within organizations. While certain regulations overseeing internal controls of listed companies were enforced by the SEBI, stringent laws supporting the same were lacking.

Every initiative requires a starting point. Notably, the inception of Internal Controls can be traced back to a significant event – the Sathyam Scam of 2009.

The Sathyam Scam of 2009:

One of the significant scandals that led to the formulation of Section 134 of the Companies Act was the Sathyam scam in 2009. In this instance, Ramalinga Raju, the Founder and Chairman of Sathyam Computer Services, admitted to manipulating the company’s accounts and inflating profits.

This revelation severely undermined the trust of investors, shareholders, and stakeholders in the Indian corporate sector, prompting concerns regarding corporate governance, accountability, and ethical conduct. Consequently, governmental intervention ensued, with a new set of Board of Directors appointed to oversee the company’s operations.

The Sathyam Scam served as a stark wake-up call, exposing the deficiencies within the regulatory framework and necessitating stringent rules and regulations. In response, the government introduced a series of reforms aimed at enhancing corporate governance and transparency. One such significant reform was the repeal of the Companies Act of 1956 and the enactment of the Companies Act of 2013. Additionally, measures such as mandatory auditor rotation, requiring auditors to be replaced every five years and audit firms every 10 years, were implemented.

Furthermore, the Companies Act of 2013 mandated the inclusion of the Director’s Responsibility Statement in the Board of Directors’ Report, aiming to enhance accountability. The establishment of the Serious Fraud Investigation Office (SFIO) as a statutory body under the Companies Act of 2013 further strengthened regulatory oversight. The SFIO focuses on investigating business and accounting fraud, playing a crucial role in maintaining integrity within the corporate sector.

The repercussions of the Satyam scam reverberated throughout the IT industry in India, tarnishing the reputation of Indian IT companies and raising doubts about their credibility and transparency. However, the industry swiftly rebounded and regained the trust of investors and clients through concerted efforts to enhance governance practices and restore confidence in their operations.

Strategies for Enforcing Internal Financial Control:

To effectively establish, monitor, and sustain Internal Financial Controls, a firm should adhere to the following procedures:

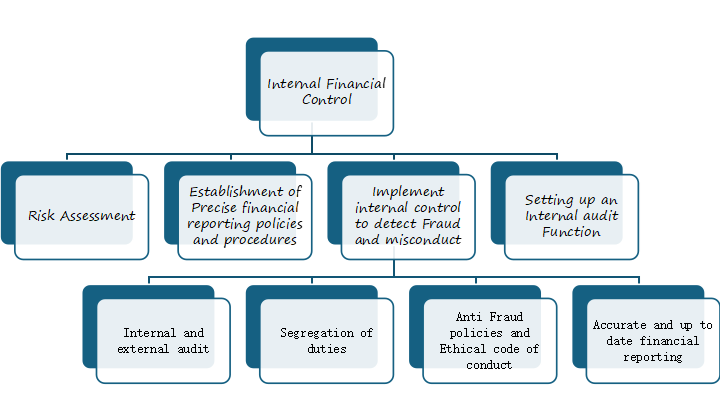

1. Risk Assessment

Financial risk assessment stands as a pivotal instrument for decision-making within organizations. It enables entities to meticulously identify, comprehend, and mitigate financial risks, thereby optimizing their business strategies and ensuring steadfast compliance with regulatory standards.

An illustration of financial risk assessment lies in credit risk analysis, a prominent type of financial risk. This involves evaluating the likelihood of a debtor defaulting on payment and the strategies implemented by the company to prevent or mitigate such occurrences to the greatest extent feasible.

Where to start and how?

Financial risk assessment entails the meticulous analysis of potential financial threats and their degree of exposure. This evaluation of risk complexity underscores the significance of considering both internal and external factors contributing to the emergence of threats. It is imperative to acknowledge that while identifying possible risks is essential, the primary aim of financial risk assessment is proactively preventing their occurrence.

Key Factors in Assessing Financial Risks: Internal and External Considerations:

Internal Factors:

- Financial structures

- Poor cash management

- Production issues

- Operational inefficiency

- Poor Management Practices

External Factors:

- Political, social, economic conditions that might affect company’s performance such as economic crisis, exchange rate instability.

- Regulatory changes

- Market volatility

By comprehensively assessing both internal and external factors, organizations can gain a holistic understanding of potential risks and develop robust strategies for risk mitigation.

One method for conducting financial risk analysis in a company involves integrating the probability of a risk event occurring with its potential economic ramifications. Upon assessing the risk and devising mitigation strategies, the company can opt to either avoid or accept the risk based on its risk appetite.

The extent of exposure to risk is typically assessed quantitatively.

The resulting data can then be utilized to construct a risk tolerance graph, delineating which risks are manageable and which pose substantial threats. Naturally, decisions should also factor in prevailing market trends, as well as macroeconomic and financial variables.

To Summarise,

The analysis of a company’s financial risk begins after all possible risk events have been identified. …

Step 1: Identify key risks. …

Step 2: Calculate the weight of each risk. …

Step 3: Create a contingency plan. …

Step 4: Assign responsibilities. …

Step 5: Set expiration dates.

Undertaking comprehensive assessments to pinpoint susceptible areas within their financial processes is an indispensable practice in the business environment.

Regular risk assessments are imperative to ensure that the company’s risk profile remains current and aligned with evolving circumstances.

2.The establishment of precise financial reporting policies and procedures,

which encompass record-keeping, documentation, and review guidelines, is essential for fostering transparency and accountability within the organization.

The primary objective of financial reporting is to facilitate strategic decision-making among finance professionals, business partners, departmental leaders, and stakeholders. This involves providing insights into a company’s operational activities, growth prospects, and future profitability, all grounded in an assessment of its overall financial well-being and stability.

Financial reporting frameworks offer both current and prospective investors, lenders, and other creditors structured insights into the financial position of the company. This information empowers them to make well-informed decisions regarding funding, extending loans, or approving/vetoing management decisions, thereby contributing to the overall transparency and efficiency of the financial market.

Characteristics of Good financial reporting Framework:

- Transparency

- Comprehensiveness

- Consistency

3.Implementing internal Controls to detect Fraud:

Business entities should deploy internal controls aimed at detecting and mitigating instances of fraud and errors. These controls may incorporate practices such as the segregation of duties, stringent authorization procedures, and vigilant monitoring of transactions.

Proactively preventing fraud is typically more cost-effective than addressing its consequences post-victimization. Establishing a robust internal control framework is paramount in this endeavour.

To safeguard against theft and mitigate potential losses that could adversely impact the company, consider implementing the following internal controls.

- Internal and external Audit

- Segregation of duties

- Anti-Fraud policies and ethical code of conduct

- Accurate and up to date financial reporting.

Internal and External Audit:

Internal and external audits serve as crucial mechanisms to investigate the presence of fraud or the potential for its emergence within your business.

Internal audits primarily focus on enhancing performance and operational efficiency within your company. On the other hand, external audits aim to verify and validate the truthfulness and accuracy of your company’s financial statements.

An internal audit should furnish you with the following:

- Identification of potential areas vulnerable to fraud.

- Understanding of the factors contributing to fraud risks within your company.

- Overview of trends and scenarios linked to high-risk fraud types potentially associated with your business.

- Evaluation of existing fraud indicators.

- Determination of the need for further investigation or action.

- Assessment of the effectiveness of controls in detecting and preventing future fraud risks.

Upon completion of the audit, leveraging tools for risk assessment and audit planning enables effective management of your company’s fraud risk.

Segregation of duties:

The segregation of duties stands as a pivotal internal control process within organizations. By implementing this practice, companies ensure that no single individual has exclusive control over the entire lifecycle of a transaction. Different responsibilities are allocated to distinct individuals to foster oversight and accuracy. Ideally, each financial transaction should involve at least two individuals. By dispersing functional responsibilities across different units, companies minimize the likelihood of errors going undetected. These responsibilities encompass:

- Initiating the transaction

- Approving the transaction

- Recording the transaction

- Reconciling the transaction

- Handling the asset

- Reviewing the report

Moreover, the segregation of duties serves as a deterrent against fraud. When duties are effectively segregated, fraudulent activities cannot be carried out independently. Any successful fraudulent act necessitates collusion or assistance from another individual.

Anti-Fraud Policies and ethical Code of Conduct:

A strong code of conduct serves as a critical anti-fraud measure, providing a definitive framework of acceptable and unacceptable behaviours. By delineating expectations, it safeguards the company’s reputation and mitigates the risk of costly regulatory and legal complications.

A robust code of conduct comprehensively outlines the company’s mission, vision, principles, values, and commitments, while aligning them with the requisite standards of moral and ethical conduct in the workplace.

Key components to include in your code of conduct to guide internal behavior are:

- Anti-fraud policy

- Incident response plan

- Whistleblower policy

- Code of business ethics

- Financial and fiscal policies governing disbursements and reimbursements.

Clearly articulating these policies establishes internal expectations and serves as a yardstick to evaluate behavior, thereby holding non-compliant employees accountable.

Accurate and up-to-date financial reporting:

Maintaining accurate accounting records and comprehensive financial reporting enhances visibility, facilitating the auditing of various activities and transactions within your business. This increased scrutiny acts as a deterrent against fraud.

Incorporating the following best practices within the financial division of an organization can significantly reduce the risk of fraud in Financial Operations:

- Documenting all sales receipts

- Documenting all bank account deposit preparations

- Avoiding the use of signature stamps

- Requiring two or more signatures on large checks

- Documenting checks on a log

- Requiring supervisor approval of employee timesheets before payroll processing

- Examining canceled checks to verify the legitimacy of third parties involved.

However, the list provided above is not exhaustive. The controls may vary depending on the industry, organizational structure, and specific risks faced by the business. It is crucial to continuously monitor, review, and adapt internal controls to evolving threats and changes in the business environment.

Regular assessments of internal controls should be conducted to identify weaknesses, gaps, or emerging risks that may require additional controls or modifications to existing ones. This ongoing review process allows organizations to stay proactive in mitigating risks and maintaining the effectiveness of their control environment.

Furthermore, regulatory requirements, industry standards, and best practices may evolve over time, necessitating updates to internal controls to ensure compliance and alignment with current guidelines. By remaining vigilant and responsive to changes, organizations can enhance their resilience against fraud and other threats while fostering a culture of continuous improvement and risk management.

4. Establish an Autonomous Internal Audit Function:

The audit function serves as a pivotal component within a robust corporate governance framework, offering independent assurance to the board of directors and executive management regarding the efficacy of internal controls and compliance within the institution’s operations.

An effective internal audit function must maintain independence from business unit influence and refrain from involvement in the daily operations of the organization. The chief audit executive should report directly to the audit committee of the board, enjoying unrestricted access to both the board of directors and executive management.

In many organizations, the chief audit executive holds administrative reporting responsibilities to the president or chief executive officer, ensuring alignment with the strategic objectives of the company while upholding the principles of independence and objectivity in audit activities.

Structure of Internal Audit Function:

When establishing the internal audit function, management possesses a degree of flexibility, as it should be tailored to the organization’s size and complexity. Some companies may opt to augment the function with external resources rather than staffing it entirely internally. The cost of the internal audit function escalates in tandem with the institution’s size and complexity. Therefore, companies should periodically assess which audits should be conducted internally versus outsourced to a third-party service provider to enhance oversight and efficiency.

Additional considerations when establishing an internal audit function include:

Accountability: While audit function duties can be outsourced, management retains accountability for the function and its outcomes.

Expertise: Auditors must possess the requisite knowledge and expertise in the relevant area(s) to be audited.

Training: Ongoing and up-to-date training is essential to ensure auditors maintain the necessary knowledge and expertise.

Independence: The audit function must remain free from influence or bias, both in appearance and in reality. This holds true whether establishing an in-house audit department or utilizing a third-party firm.

Vendor Management: When outsourcing the function, evaluate external resources in line with the vendor management program. It’s crucial to remember that they operate as an extension of your staff, and you bear ultimate responsibility for their actions.

It should be noted that Enterprises should ensure that their Internal Financial Controls (IFCs) undergo regular assessment and adaptation to accommodate emerging risks, evolving best practices, and shifts in the business landscape.

Indeed, robust internal financial controls serve as the foundation for maintaining the integrity and reliability of financial information within an organization. By ensuring adherence to laws and regulations, they offer assurance to stakeholders such as investors, creditors, and regulators that the organization’s financial operations are conducted responsibly and transparently. This, in turn, fosters trust and confidence in the management practices of the organization.

Legal Compliance: Companies Act 2013 Directives on Internal Financial Controls.

| Provision | Area | Mandate | Applicability |

| Section 134 (5)(e) of Companies Act 2013 | Directors Responsibility | The board of directors are responsible for affirming the establishment of Internal Financial Controls (IFC) and ensuring their adequacy and effectiveness. | Listed Entities |

| Rule 8 (5) of companies Accounts rules 2014 | Board of directors’ report | The report should contain details regarding the adequacy of Internal Financial Controls (IFCs) concerning the financial statements. | All entities (Listed/Unlisted) |

| Section 149 (7), schedule IV of the companies Act 2013 | Independent directors | The Directors should ensure complete satisfaction regarding the robustness and defensibility of the organization’s financial integrity, financial controls, and risk management systems. | All entities having independent directors |

| Section 177 of the companies Act 2013 | Audit Committee | Audit Committee to conduct a comprehensive evaluation of both Internal Financial Controls (IFC) and risk management practices. | All entities having Audit Committee. |

| Section 143 (3) (i) of companies Act 2013 | Auditor Report | Auditors are mandated to report on the adequacy of Internal Financial Controls (IFCs) and their operational effectiveness within the company. | All entities (Listed/Unlisted) |

Gains from Internal Financial Control: Enhancing Financial Governance:

- Effective Risk Management and Asset Protection.

- Ensuring Precision in Financial Reporting.

- Promoting Transparency for a Trustworthy and Ethical Business Environment.

- Implementation of Segregation of Duties.

- Optimization of Operational Efficiency.

- Meeting Compliance Requirements.

Conclusion:

Internal controls serve as the foundation of a well-structured and resilient organization. By implementing robust internal controls, every organization has the opportunity to continuously enhance its internal control environment. Both the Board of Directors and auditors pay close attention to this concept as it fosters trust and transparency among stakeholders, thereby attracting more investments.

With the aforementioned significance and benefits, it becomes evident that maintaining proper control over finances leads to improved efficiency, accurate financial reporting, proactive detection and avoidance of risks, and compliance with laws and regulations as stipulated by the Companies Act. While the initial stages of implementation may pose challenges, the advantages far outweigh the obstacles.

With a strong internal control system in place, businesses can confidently navigate the complexities of the business world and seize opportunities for growth.